Know your overdraft options - Consumer Financial Protection Bureau

Jun 4, 2025 · An overdraft occurs when you don’t have enough money in your account to cover a transaction, and the bank or credit union pays for it anyway. You then have to pay back the amount …

Understanding Overdraft: Fees, Types, and Protection Options

An overdraft allows you to continue transactions when your account lacks funds. This bank-provided credit lets you settle payments but may incur fees and interest. Essentially, it's an extension...

Overdraft - Wikipedia

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be " …

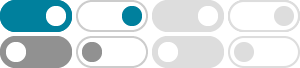

Overdraft Protection: What It Is and Different Types

Nov 12, 2025 · Overdraft protection is a checking account feature that some banks offer as a way to help you avoid overdraft fees. There are several types of overdraft protection, including overdraft...

What is an Overdraft? (& Types of Overdraft Protection) - BILL

While an overdraft is never desirable, it ensures that your checks and debit card transactions go through even when you don't have sufficient available funds in your account. This processing ensures that …

What Is an Overdraft Fee? - Business Insider

Apr 28, 2025 · Explore what an overdraft fee is, why it occurs, and how to avoid charges in 2025. We highlight banks that have eliminated various overdraft fees.

Overdraft Services for Personal Accounts - Wells Fargo

Learn about Overdraft Protection and overdraft services that can cover your transactions if you don’t have enough available money in your account. See how you can avoid overdrafts and overdraft fees.

Overdrafting: What is it and how does it work? | Capital One

This is called an overdraft—when you spend or withdraw more than you have in your account, but the transaction still goes through. 1 Much of the time, this is possible through a service called overdraft …

Overdraft Protection: How It Works & What It Costs | Britannica Money

Overdraft protection allows you to make purchases even if you don’t have enough money in your bank account. Overdraft arrangements vary, but many involve a flat fee for each overdrawn transaction.

You could overdraw your account if the bank a lows the $10 purchase to be processed. This could cost you expensive overdraft fees. The amount you are overdrawn plus your bank’s fees will be deducted …